Support

About File Expenses

We help you File Expenses Quickly, Easily, Around the Clock, Around the World, in Any Currency.

We simplify and streamline the process removing the hassle you experience submitting expense reports to claim your expenses. We deliver a transparent approval process for those who have to approve these expense reports and we keep everybody informed along the way. With File Expenses, Expense Reports really are ... a piece of cake! Oh, just one more thing, we do it really well too!

Using a mobile device such as a smartphone and our File Expenses App, you can access your account; take a photograph of a receipt with our QuickSnap function; add some information (a little if you are in a hurry or more detailed if you have a moment); add this expense claim to an expense report which you can also create (in fact, you can create multiple reports for your business needs) and submit to your online account. This online account is the meeting place for our Submitters and their Approvers. We link each, keep each informed on progress as expense reports are submitted and approved and also provide information on payment status.

If you are self-employed, a contractor or freelance, you can create expense claims, add to either an expense report and submit to your online account. Here you can build out an expense claim or an invoice, add billable time, tax id and any description required before submitting your invoice or expense claim to your client.

All our users (submitters, approvers and administrators) and our organisations (professionals, small and medium enterprise and corporate) move freely within the File Expenses ecosystem. They have access to Rulesets which guide the submission of expenses; wonderful analytics to keep an eye on what is happening, what the spend is and on ensuring compliance; allocation to cost centres; VAT and Sales Tax analyses; and much more.

In addition, all users can avail of our Personal Expense Budgeting tools within the smartphone or tablet app to Quicksnap receipts and bills and link to personal expenditure. Personal Expense Budgeting is currently integrated with Google Drive so you can use your GMail account to login. Your personal receipts and bills are then saved to your Google Drive account. You can link these receipts and bills to your budget line items online.

The benefits for companies are endless: Compliance with company expense policies; Easy to use expense management system; Automated expenses approvals system; Audit ready electronic receipts & expenses; Expense cost reduction, expense spending limits; Cloud, mobile expense processing & approval; Reduced expense reports creation & approval times; Corporate expense card integration; Visibility into expense spending data; Automated & faster expenses processing & payment; Exception & non-compliance reporting and Increased workforce efficiency & budget savings.

For those of you in Ireland, the United Kingdom and the United States: we have localised our systems to include the local revenue requirements and you can opt to use these or our general systems. This app works directly with each localised version of File Expenses.

Our complete ecosystem is built just for you and we have just begun. We have some real exciting things in our pipeline which will, truly, make Expense Reports a 'piece of cake' to submit and to approve.

The benefits for our users are awesome. With File Expenses, Expense Reports really are ... a piece of cake!

App Support & Guidelines

App support is being updated on a regular basis with each version.

Once our apps are released in final format we will add extensive details linked to screenshots.

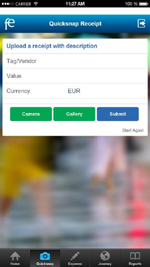

Quicksnap Receipt

Create an expense item value and attach a receipt using Quicksnap or library.

Complete remaining details online later.

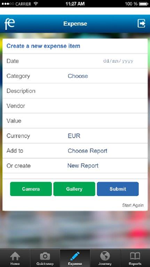

New Expense

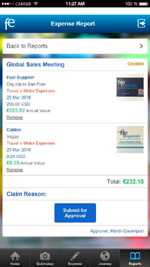

Fully detailed expense item:

- Complete expense details with expense type, vendor (or other description), currency and value.

- Add to a new expense report or to an existing report.

- Attach a receipt using Quicksnap or select from library.

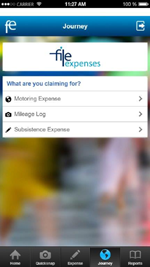

Journey

You may claim detailed expenses for work related journeys.

- Motoring expenses, motoring log or travel subsistence/per diem options.

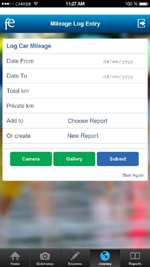

Motoring Log

Motoring or mileage log can be added to Expense Reports (with a zero value claim) or to a Mileage Report (an expense report titled Mileage and with zero value).

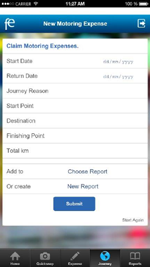

Motoring Claim

Motoring or mileage expenses claim option included with dynamic rates and units of distance.

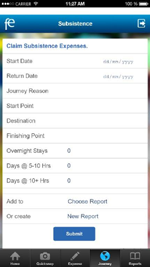

Overnight/Subsistence

Subsistence, per diem or journey accommodation rates may be claimed. Available by location and company. Totally customised and database driven.

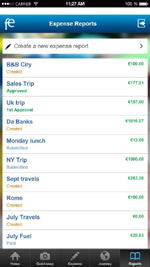

Expense Reports List

Create Expense Reports and view summary listing with status (created, submitted, approved) & value indicated.